AI in weather forecasting, prediction and communication

Continue readingDuring the past two years, the automotive industry has seen substantial swings in supply and demand. This, along with changes in customer preferences, has made marketers reconsider their approach to advertising.

Technological advances are creating opportunities that can help solve these challenges. Using new AI-powered tools, it’s becoming possible to extract actionable insights from previously untapped data.

In this article, we’ll introduce automotive advertising and discuss the current state of the automotive marketing landscape. Then, we’ll take a look at some of the major challenges facing the automotive industry and how companies can evolve to address these challenges.

What is automotive advertising?

Automotive advertising involves targeting people who are in the market for a new or used vehicle with content that is likely to convince them to make a purchase decision. Since customers may not buy a car again for years, advertising campaigns may also seek to engage current clients and drivers.

What began with simple car descriptions, has evolved to creative, narrative-driven ads that appeal to viewer emotion. To keep customers’ attention in the fiercely competitive industry, a new approach to advertising is now required.

The marketing funnel in automotive

Much of the automotive customer journey happens before the customer ever enters a car dealership. This is especially true in a post-pandemic world, where 7 out of 10 consumers note that they’d rather shop digitally than go to a dealership. Research from Cox Automotive suggests that 76% of buyers are happy to conduct the entire purchase online. For automotive manufacturers, having an online footprint has always been important, but the shift caused by COVID-19, makes these touchpoints even more valuable.

The car buyer’s journey is spread across the full digital ecosystem, with touchpoints from search to vehicle description pages, third-party websites, and social media advertisements. Companies need to ensure that these experiences offer personalized creative and messaging in order to fully engage consumers. To avoid wasting precious budget, these touchpoints need to move leads along and target the right people.

If automotive marketers want to attract customers, they need to be able to leverage key digital insights to understand customer intention and the best creative to increase engagement at each touchpoint. Only with this data in hand is it possible to target customers using the channels that are most likely to convert.

The current landscape of automotive advertising

The traditional automotive marketing model has shifted significantly to a mostly digital approach. Previously, most of the action occurred in the dealership, but now almost all prospective customers spend a significant amount of time researching vehicles online before making a purchase decision. For car manufacturers looking to remain competitive, the focus must also be on these digital touchpoints. Consumers will likely decide on their vehicle prior to going to a dealership, if they even make the in-person visit.

It’s becoming harder to target and influence prospective auto shoppers due to shifts in data collection and consumer privacy. In a cookieless future, it’s more difficult to achieve results across the entire digital ecosystem, resulting in a lack of actionable insights and less understanding of customers.

Challenges facing the automotive industry

As if the ever-evolving landscape of digital advertising wasn’t challenging enough, the automotive industry now faces several other challenges:

Supply chain issues and production delays

Because of semiconductor supply issues, manufacturers haven’t had enough chips to build as many cars, resulting in production delays and profit loss. Even if consumers want new cars, the ability to create these cars is not there. Companies must focus on their most profitable vehicles to combat these delays. Organizations are also forced to decide which activities are most beneficial and where to spend media dollars. Proving ROI becomes more important when advertising dollars are stretched thin.

The switch to electric

Huge investments are needed to switch to electric car production, yet electric vehicles (EVs) are less profitable than gas vehicles (especially in the short term). Despite the growing demand for electric vehicles, the 16 EV models analyzed by McKinsey are at best only slightly above breaking even in terms of cost. As more companies seek to produce EVs, materials will become more expensive. Constructing an EV battery could cost companies 22% more by 2026 as raw materials become more scarce.

Car companies also face an increased risk that they are building cars that consumers may not buy. However, the spike in gas prices may encourage drivers to purchase EVs over internal combustion engines (ICE). Nearly 4 out of 10 (38%) of new car buyers are considering EVs for their next purchase.

An increasingly competitive industry

Competition from newcomers such as Tesla, Rivian, and Lucid on top of established brands means that brands need to act quickly to stay competitive. ICE manufacturers must play catch-up with these already established industry leaders in the EV space.

Traditional car companies are putting large amounts of money into this transition. Volkswagen aims to have at least 50% of its sales come from EV by 2030. Toyota plans to invest $35 billion into electric car research and development.

Increasing costs

Higher energy costs and inflation are increasing costs for manufacturers. These costs are also reflected on the consumer, making it more expensive to buy a car. Some 69% of consumers worry that pricing for new cars will become too expensive for the average consumer. As a result, car companies may explore new options for leasing or subscription models.

Less demand

There is less demand for new cars as people are using alternative mobility solutions like Uber and Lyft. However, despite less demand, 50% of Americans plan to drive more this year than they did last year.

The next steps for automotive companies

To address these challenges, automotive companies need to be able to extract better insights from their data and use them to create premium, personalized and branded experiences for customers. Advertising dollars and budget matters now more than ever: Companies must ensure that each dollar spent is driving revenue.

Marketers can now utilize AI advertising solutions to predict and deliver the ads that are most likely to increase engagement and conversions. AI offers a new approach to advertising that is built from data yet puts privacy first while delivering actionable insights fast and enabling large-scale personalization. Actioned across the entire ecosystem, AI can provide:

Dynamic creative optimization

Machine learning can help deliver personalized creative variations by user or household that drive real outcomes and deliver on marketing KPIs. Using AI, teams can test hundreds of creative variables before implementing a single strategy.

Predictive targeting

Finding new audiences is challenging, especially with new targeting constraints. Predictive Audiences helps brands reach new audiences without third-party cookies and mobile ad identifiers by tapping into a brand’s existing data.

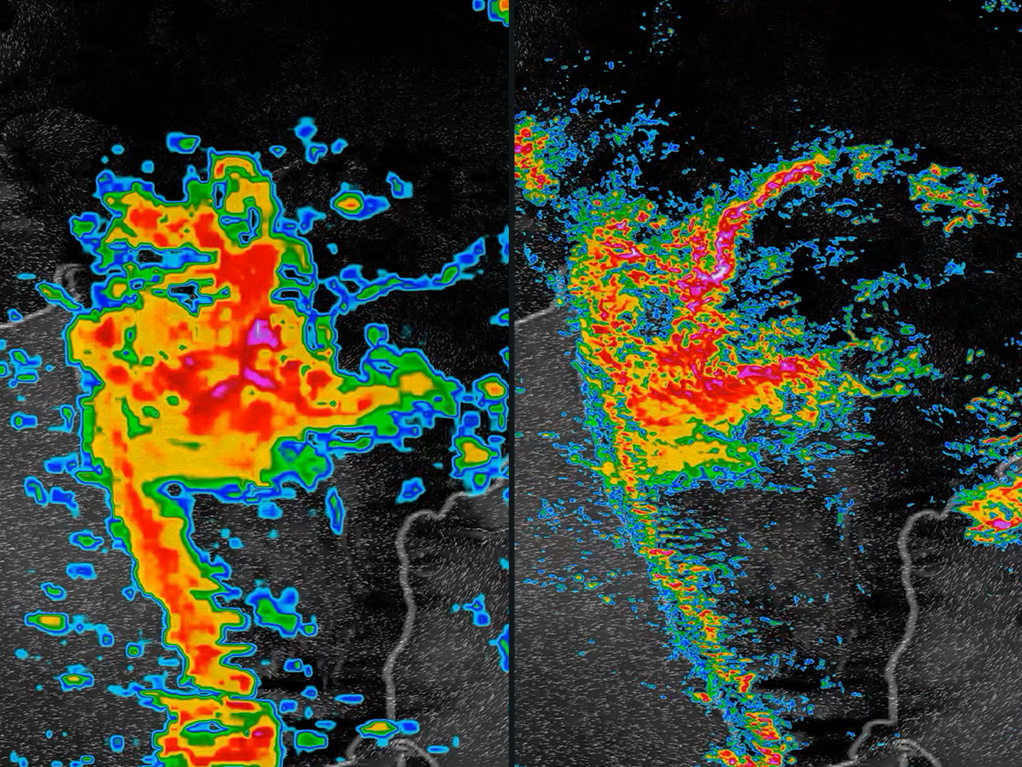

Weather analytics and targeting

Weather is a privacy-friendly predictor of consumer behavior. With AI-powered Weather Analytics, brands can make strategic decisions that are curated for the automotive industry based on the most accurate forecasts available.

Conversational marketing

Engage consumers one-to-one in rich, personalized dialogue to provide value to the customer while obtaining insights previously unavailable to brands. Conversations help to showcase brand empathy, deepen customer loyalty, and improve user satisfaction.

Toyota Prius uses the first cognitive ads in the automotive industry

Toyota and The Weather Company collaborated to develop the first cognitive ads for the automotive industry. Watson was trained using the Prius Prime’s vehicle information and FAQs to enable direct dialogue with users. At the end of the campaign, Toyota had 6,000 conversations with consumers. Additionally, males between the ages of 35-49 increased their purchase consideration by 20%.

Combining the real-time conversation capability with dynamic, targeted ads, Toyota saw improvements in interactions, engagement, and increased purchase consideration in the target audience.

Final thoughts

The automotive industry is undergoing significant growing pains as the manufacturing and consumer preference landscapes shift. To address these challenges, automotive marketers need to change their traditional approach and look to powerful new solutions.

The Weather Company offers a suite of advertising solutions that can optimize customer targeting, create personalized experiences, and increase engagement across the entire automotive marketing funnel. To learn more, contact us today.

Let’s talk

What’s your weather strategy? To learn more about increasing campaign efficiencies and personalizing messages at the most relevant moments, contact our advertising experts today.

Contact us